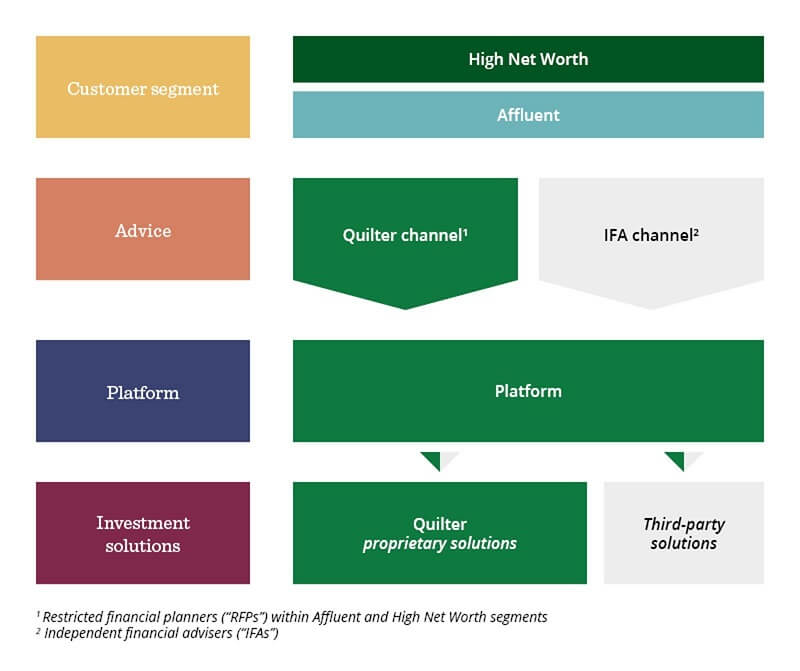

Our business model supports our advisers and their clients as their financial requirements evolve throughout their lives and is comprised of two client-focused segments: High Net Worth and Affluent.

Our business model

High Net Worth

- Quilter Cheviot, a discretionary fund management business and financial planning business.

Affluent

- Quilter Financial Planning, one of the UK’s largest distributors of financial advice;

- Quilter investment platform, an award-winning investment platform and

- Quilter Investors, the multi-asset investment solutions business.

A typical UK-based customer approaching Quilter to manage their wealth needs three things:

- ‘a financial plan’;

- a means of holding their assets safely (‘Platform’) in the right tax efficient wrapper; and

- an investment strategy aligned with their risk appetite and investment horizon – ‘solutions’.

We earn revenues from the assets under our management or administration as a result of providing advice-led investment solutions and our platform to customers across the UK.

Quilter has a multi-channel access model, with two core strategies – the first whereby customers can come to us through our advisers or secondly through the open market channel with their own independent adviser.

When we support a customer to manage their wealth in more than one area, and therefore earn more than one revenue stream, we refer to it as an ‘integrated flow’.

The unbundled, open nature of our model, offering flexibility to use one, two or all three components:

- provides customers and their advisers with choice at every stage and imposes external market discipline on our propositions

- provides Quilter with greater market breadth, customer and adviser choice, supporting long-term customer relationships.

Our strategy

Our strategy is focused on meeting the needs of our clients across the UK and elsewhere. Our goal is to support our clients to build brighter financial futures for every generation.

Our business

Quilter is a UK focused wealth manager. Supporting financial advice is central to our propositions. We offer services to clients and their advisers. Our Platform and investment solutions are available on similar terms to both our own advisers and independent advisers, enabling us to remain competitive with third party market offerings in terms of pricing and proposition, thereby ensuring good client outcomes

We administer and manage client assets that have originated from financial advisers through two channels: our own Quilter advisers and Independent Financial Advisers (“IFAs”).

Our strategic priorities:

Grow distribution

Continue to grow market share and increase productivity, achieving ‘best in class’ new business flows. Serve a broader range of customers and clients.

Enhance propositions

Operate in a highly customer-centric way, delivering good customer outcomes and brighter financial futures. Anticipate future needs and deliver stand out innovations.

Be future fit

Continue to simplify and modernise our organisation. Invest to grow; develop data and AI capabilities; and leverage new technology. Contribute to an inclusive workplace and advance our culture and talent agenda to be a high-performing organisation.

Quilter believes that a company’s values must reflect what it stands for as they drive the achievement of its purpose. Ensuring colleagues embody Quilter’s cultural values of doing the right thing, always being curious, embracing challenge, and being stronger together connects the business and shapes behaviour towards all our stakeholders. Having the right culture will help Quilter achieve its strategy while delivering sustainable long-term value for all.